How to Reduce Delinquent Payments in Child Care Businesses

Beny Mizrachi

9 min read

Make your families & teachers happier

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

Make your families & teachers happier

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

Delinquent payments can have a significant impact on the way you manage childcare billing. As a childcare business, delinquent payments impact your cashflow and, in the most serious cases, may cause your business to close. For families, delinquent payments may lead to losing their spot in your child care program alongside potentially upsetting discussions.

In this article, we’ll explore what delinquent child care payments are, their consequences, and how to prevent delinquent payments.

What are Delinquent Child Care Payments?

Delinquent child care payments refer to payments that are overdue or unpaid by parents or guardians for child care services. This can be anything from tuition deposits, recurring tuition billing, or one-off fees (late fees, field trips, etc). As a child care business, your most frequent payment collection is tuition to cover the costs of providing care for children. Tuition is typically collected on a recurring basis (weekly, bi-weekly, or monthly).

How Does Delinquency Impact Providers and Families?

The effects of delinquent child care payments can be detrimental to providers who rely on these payments to cover their expenses, such as staff salaries, facility maintenance, and supplies.

When payments are not made on time or not at all, it can create financial strain and make it difficult for providers to continue offering quality care. You may lose staff members, be unable to pay rent, or unable to pay yourself - all of these can cause your business to close and will impact all of your families, not just the family that is overdue in their payments.

You should strive to have as few delinquent payments as possible.

For families, delinquent child care payments can resulting in suspension or termination of child care services, leaving parents or guardians in a difficult position to find alternative care.

Proactive Strategies to Prevent Delinquency

To reduce delinquent child care payments, you, as a child care provider, must implement proactive strategies.

Here are some effective strategies to consider:

Clear Communication of Payment Policies

You should clearly communicate your payment policies in your policy handbook. Make sure to share this with families when they join your program and have them sign off that they have read and agree to your policies.

Need help bulletproofing your policies? Check out our comprehensive guide to writing your child care policies.

For your policies, make sure you outline the following:

Tuition collection frequency

Accepted payment methods

Consequences for late or missed payments

By setting clear expectations, families are more likely to understand their obligations and make timely payments.

Flexible Payment Options

Offering flexible payment options can help families manage their child care expenses more effectively. This can include accepting different payment frequencies (weekly, bi-weekly, monthly), allowing payments to be made online or through mobile apps, or offering discounts for early or on-time payments. By accommodating different financial situations, you can increase the likelihood of receiving timely payments.

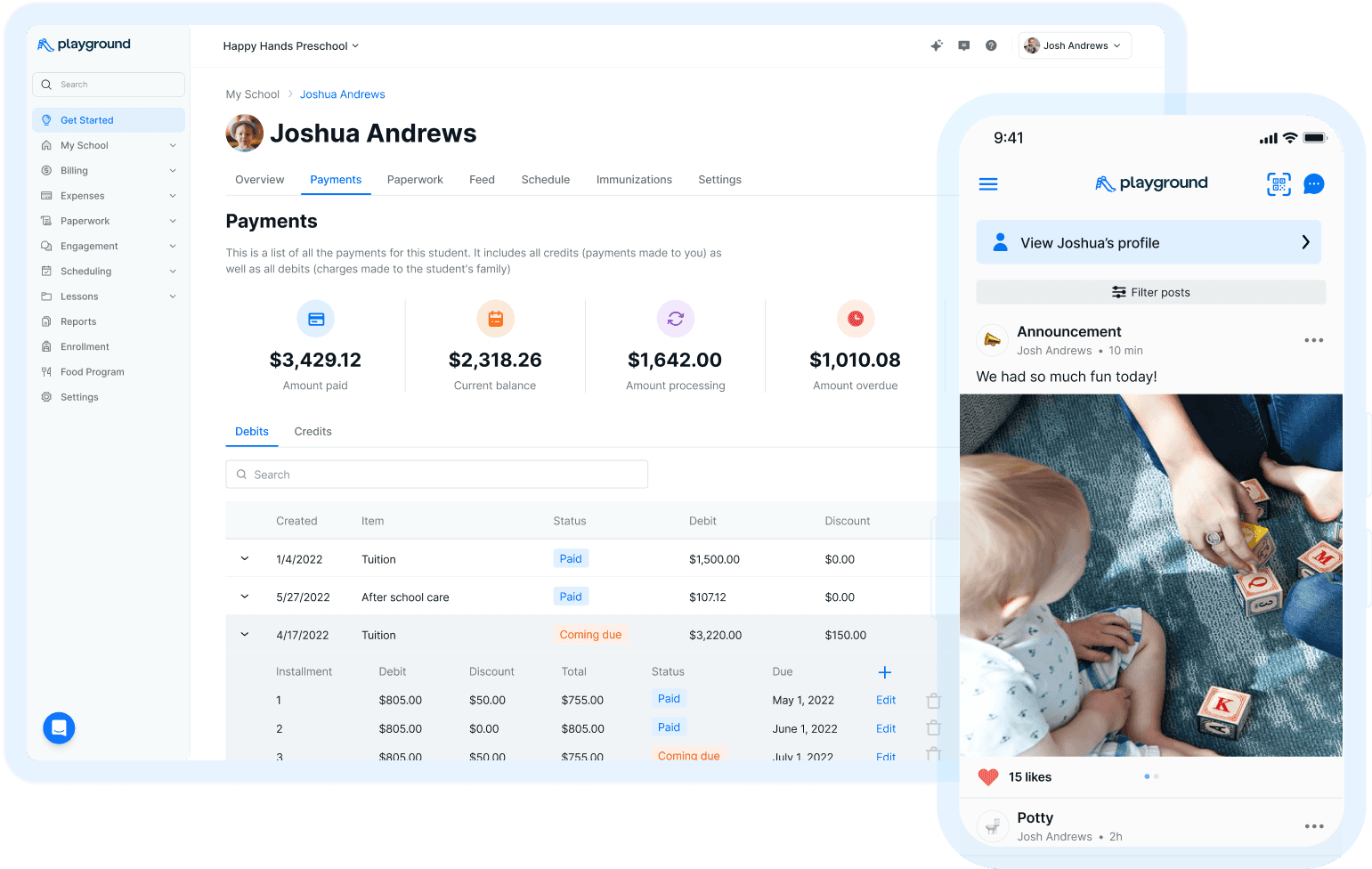

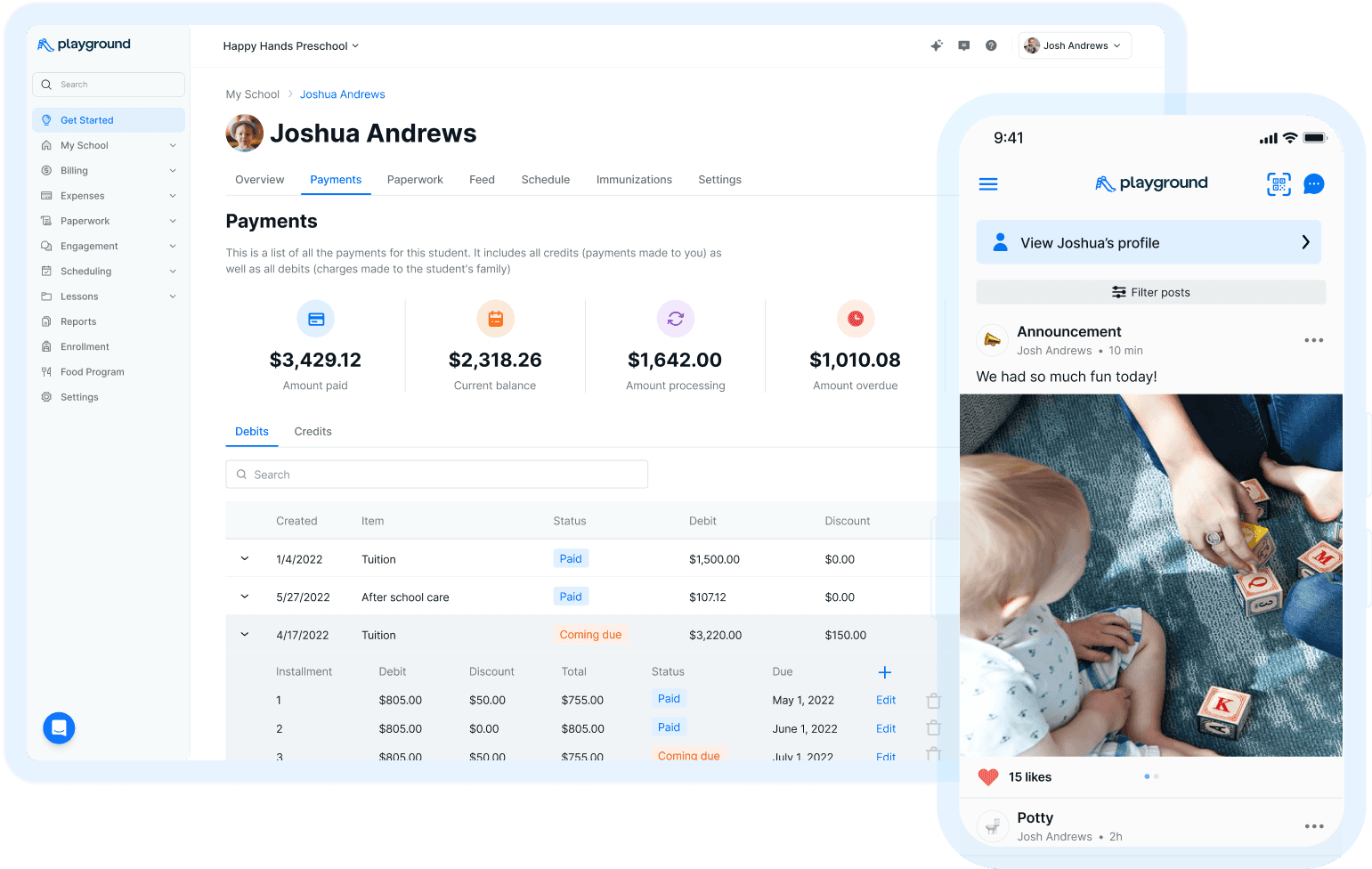

Playground makes it easy for child care providers to offer flexible payment options. Through the billing tool, administrators can create and edit payment plans, with options and customization of payment frequency.

Early Identification of Payment Issues

Providers should establish a system to identify potential payment issues early on. This can include regular monitoring of payment records, proactive communication with families who consistently make late payments, and offering assistance or resources to families facing financial difficulties.

By addressing payment issues promptly, providers can prevent them from escalating into consistent delinquency.

Playground automatically sorts which students have overdue balances in the “statements” section. This makes it easy for you to understand which families are late on payments and need to be contacted.

Effective Payment Collection Techniques

In addition to proactive strategies, you can employ effective payment collection techniques to reduce delinquency. Consider trying the following techniques:

Setting Up Automated Payment Systems

Implementing automated payment systems streamlines the payment process for families and reduces the likelihood of late or missed payments. Providers can set up recurring payments or send automated reminders to families, ensuring that payments are made on time.

Playground automatically sends upcoming payment deadline reminders to your families, taking another task off your list.

Implementing Late Fees and Incentives

By implementing late fees for overdue payments and incentives like discounts or credits for on-time payments, providers can encourage families to prioritize their payment obligations. Late fees can serve as a deterrent for delinquency, while incentives can reward families for their timely payments.

Set up automatic late fees within Playground and review them before either charging them to your family accounts or forgiving the fee. Check out this video for more information on how to add late fees on Playground.

Offering Payment Plans

For families facing financial difficulties, offering payment plans can provide them with a manageable way to fulfill their payment obligations. Providers can work with families to establish a payment schedule that fits their budget, ensuring that payments are made consistently.

Implementing these payment techniques is a breeze on Playground. From payment plans to late fees and incentives, Playground can help you avoid delinquent payments and manage billing all in one place with easy-to-use features like payment reminders to inform guardians about overdue payments.

Intervention Methods for Delinquent Accounts

Despite proactive strategies and effective payment collection techniques, some accounts may still become delinquent. In such cases, you can consider intervention methods to address delinquency.

Here are some steps you can take:

Mediation and Counseling Services

Providers can offer mediation or counseling services to families with delinquent accounts. This can help identify the underlying reasons for non-payment and explore potential solutions. Mediation can be a constructive way to resolve payment disputes and establish a repayment plan.

Working with Collection Agencies

In cases where other methods have been unsuccessful, providers may choose to work with collection agencies. These agencies specialize in recovering delinquent payments and can take legal action if necessary.

However, you need to ensure compliance with applicable laws and regulations when you engage with collection agencies.

Legal Actions and Court Procedures

As a last resort, you may need to pursue legal actions and court procedures to recover delinquent payments. This can involve filing a lawsuit against the non-paying party and seeking a judgment for the owed amount.

Legal actions should be taken following local laws and with the guidance of legal professionals. This is a bigger financial investment and takes considerable effort.

Federal Support

The federal government provides support and enforcement measures to address delinquent child care payments. This includes programs such as the Child Care and Development Fund (CCDF), which provides financial assistance to low-income families for child care services.

Additionally, federal agencies may enforce child support orders to ensure that parents fulfill their financial obligations.

Technological Solutions to Manage Payments

Technology can play a significant role in managing child care payments more efficiently. Here are some technological solutions to consider:

Utilizing Child Care Management Software

Child care management software can streamline payment processes by automating tasks such as invoicing, payment tracking, and reporting. These software solutions can help providers stay organized, reduce administrative burdens, and improve overall payment management.

Mobile Payment Apps and Platforms

Mobile payment apps such as Venmo or Zelle provide convenience for families to make payments on the go. Keep in mind that starting in 2024, you will need to submit a 1099-K form to the IRS to report revenue received from third-party payment networks like Venmo or CashApp.

Currently, third-party payers must issue a 1099-K if a taxpayer has over $20,000 in gross revenue or 200 transactions on the platform. By offering mobile payment options, providers can increase the accessibility and ease of making payments, reducing the likelihood of delinquency.

In Playground, you can easily track payments made in third-party payment networks, keeping your books organized and simplifying your taxes.

Online Payment Portals and Security

Implementing secure online payment portals can provide families with a safe and convenient way to make payments. These portals can offer encryption and other security measures to protect sensitive financial information. By ensuring the security of online payments, providers can build trust with families and encourage timely payments.

Playground’s billing tool offers features such as invoicing, payment tracking, and reporting. Parents can pay their balance through both the Playground mobile app and the web with Stripe, Playground’s secure payment processor.

Support Resources for Families

Child care providers can also provide information and resources to support families in meeting their payment obligations. Here are some support resources to consider:

Government Assistance Programs

Inform families about government assistance programs that can help cover child care costs. These programs may include subsidies, vouchers, or tax credits that can alleviate financial burdens for families.

Non-Profit Organizations and Charities

Connect families with non-profit organizations and charities that offer financial assistance for child care expenses. These organizations may have specific eligibility criteria, but they can provide valuable support to families in need.

Community-Based Support Systems

Encourage families to seek support from community-based organizations or support groups. These networks can provide guidance, resources, and advice on managing child care payments effectively.

Best Practices for Child Care Providers

To minimize delinquent child care payments, providers should adopt best practices in their operations. Here are some best practices to consider:

Regular Financial Audits

Conduct regular financial audits to ensure accuracy and transparency in payment records. Audits can help identify any discrepancies or errors and allow providers to address them promptly.

Training Staff on Payment Processes

Ensure that administrative staff members are well-trained in payment processes and policies. This includes educating them on how to handle payment-related inquiries, assist families with payment options, and address any payment issues that may arise.

Maintaining Positive Relationships with Families

Building and maintaining positive relationships with families can help foster open communication and trust. Providers should strive to create a supportive and understanding environment where families feel comfortable discussing payment concerns or difficulties.

Conclusion

Addressing delinquent child care payments is crucial for both child care providers and families. By implementing proactive strategies, effective payment collection techniques, and utilizing technological solutions, providers can reduce delinquency rates and ensure the financial stability of their operations.

Leveraging software such as Playground can streamline your payment collection process and reduce delinquent payments, while even potentially boosting revenue with automated late fees.

Additionally, by providing support resources and adopting best practices, providers can help families navigate their payment obligations and maintain access to quality child care services.

Ultimately, you are a business and should be treated as one. Just as your families would not second-guess paying Amazon on time for their services, they should be respectful of your services and pay on time.

Be sure to have policies and procedures in place to clarify your payment collection process. Additionally, supporting families in meeting their payment obligations can alleviate financial stress and contribute to a positive and trusting relationship between providers and families.

Delinquent payments can have a significant impact on the way you manage childcare billing. As a childcare business, delinquent payments impact your cashflow and, in the most serious cases, may cause your business to close. For families, delinquent payments may lead to losing their spot in your child care program alongside potentially upsetting discussions.

In this article, we’ll explore what delinquent child care payments are, their consequences, and how to prevent delinquent payments.

What are Delinquent Child Care Payments?

Delinquent child care payments refer to payments that are overdue or unpaid by parents or guardians for child care services. This can be anything from tuition deposits, recurring tuition billing, or one-off fees (late fees, field trips, etc). As a child care business, your most frequent payment collection is tuition to cover the costs of providing care for children. Tuition is typically collected on a recurring basis (weekly, bi-weekly, or monthly).

How Does Delinquency Impact Providers and Families?

The effects of delinquent child care payments can be detrimental to providers who rely on these payments to cover their expenses, such as staff salaries, facility maintenance, and supplies.

When payments are not made on time or not at all, it can create financial strain and make it difficult for providers to continue offering quality care. You may lose staff members, be unable to pay rent, or unable to pay yourself - all of these can cause your business to close and will impact all of your families, not just the family that is overdue in their payments.

You should strive to have as few delinquent payments as possible.

For families, delinquent child care payments can resulting in suspension or termination of child care services, leaving parents or guardians in a difficult position to find alternative care.

Proactive Strategies to Prevent Delinquency

To reduce delinquent child care payments, you, as a child care provider, must implement proactive strategies.

Here are some effective strategies to consider:

Clear Communication of Payment Policies

You should clearly communicate your payment policies in your policy handbook. Make sure to share this with families when they join your program and have them sign off that they have read and agree to your policies.

Need help bulletproofing your policies? Check out our comprehensive guide to writing your child care policies.

For your policies, make sure you outline the following:

Tuition collection frequency

Accepted payment methods

Consequences for late or missed payments

By setting clear expectations, families are more likely to understand their obligations and make timely payments.

Flexible Payment Options

Offering flexible payment options can help families manage their child care expenses more effectively. This can include accepting different payment frequencies (weekly, bi-weekly, monthly), allowing payments to be made online or through mobile apps, or offering discounts for early or on-time payments. By accommodating different financial situations, you can increase the likelihood of receiving timely payments.

Playground makes it easy for child care providers to offer flexible payment options. Through the billing tool, administrators can create and edit payment plans, with options and customization of payment frequency.

Early Identification of Payment Issues

Providers should establish a system to identify potential payment issues early on. This can include regular monitoring of payment records, proactive communication with families who consistently make late payments, and offering assistance or resources to families facing financial difficulties.

By addressing payment issues promptly, providers can prevent them from escalating into consistent delinquency.

Playground automatically sorts which students have overdue balances in the “statements” section. This makes it easy for you to understand which families are late on payments and need to be contacted.

Effective Payment Collection Techniques

In addition to proactive strategies, you can employ effective payment collection techniques to reduce delinquency. Consider trying the following techniques:

Setting Up Automated Payment Systems

Implementing automated payment systems streamlines the payment process for families and reduces the likelihood of late or missed payments. Providers can set up recurring payments or send automated reminders to families, ensuring that payments are made on time.

Playground automatically sends upcoming payment deadline reminders to your families, taking another task off your list.

Implementing Late Fees and Incentives

By implementing late fees for overdue payments and incentives like discounts or credits for on-time payments, providers can encourage families to prioritize their payment obligations. Late fees can serve as a deterrent for delinquency, while incentives can reward families for their timely payments.

Set up automatic late fees within Playground and review them before either charging them to your family accounts or forgiving the fee. Check out this video for more information on how to add late fees on Playground.

Offering Payment Plans

For families facing financial difficulties, offering payment plans can provide them with a manageable way to fulfill their payment obligations. Providers can work with families to establish a payment schedule that fits their budget, ensuring that payments are made consistently.

Implementing these payment techniques is a breeze on Playground. From payment plans to late fees and incentives, Playground can help you avoid delinquent payments and manage billing all in one place with easy-to-use features like payment reminders to inform guardians about overdue payments.

Intervention Methods for Delinquent Accounts

Despite proactive strategies and effective payment collection techniques, some accounts may still become delinquent. In such cases, you can consider intervention methods to address delinquency.

Here are some steps you can take:

Mediation and Counseling Services

Providers can offer mediation or counseling services to families with delinquent accounts. This can help identify the underlying reasons for non-payment and explore potential solutions. Mediation can be a constructive way to resolve payment disputes and establish a repayment plan.

Working with Collection Agencies

In cases where other methods have been unsuccessful, providers may choose to work with collection agencies. These agencies specialize in recovering delinquent payments and can take legal action if necessary.

However, you need to ensure compliance with applicable laws and regulations when you engage with collection agencies.

Legal Actions and Court Procedures

As a last resort, you may need to pursue legal actions and court procedures to recover delinquent payments. This can involve filing a lawsuit against the non-paying party and seeking a judgment for the owed amount.

Legal actions should be taken following local laws and with the guidance of legal professionals. This is a bigger financial investment and takes considerable effort.

Federal Support

The federal government provides support and enforcement measures to address delinquent child care payments. This includes programs such as the Child Care and Development Fund (CCDF), which provides financial assistance to low-income families for child care services.

Additionally, federal agencies may enforce child support orders to ensure that parents fulfill their financial obligations.

Technological Solutions to Manage Payments

Technology can play a significant role in managing child care payments more efficiently. Here are some technological solutions to consider:

Utilizing Child Care Management Software

Child care management software can streamline payment processes by automating tasks such as invoicing, payment tracking, and reporting. These software solutions can help providers stay organized, reduce administrative burdens, and improve overall payment management.

Mobile Payment Apps and Platforms

Mobile payment apps such as Venmo or Zelle provide convenience for families to make payments on the go. Keep in mind that starting in 2024, you will need to submit a 1099-K form to the IRS to report revenue received from third-party payment networks like Venmo or CashApp.

Currently, third-party payers must issue a 1099-K if a taxpayer has over $20,000 in gross revenue or 200 transactions on the platform. By offering mobile payment options, providers can increase the accessibility and ease of making payments, reducing the likelihood of delinquency.

In Playground, you can easily track payments made in third-party payment networks, keeping your books organized and simplifying your taxes.

Online Payment Portals and Security

Implementing secure online payment portals can provide families with a safe and convenient way to make payments. These portals can offer encryption and other security measures to protect sensitive financial information. By ensuring the security of online payments, providers can build trust with families and encourage timely payments.

Playground’s billing tool offers features such as invoicing, payment tracking, and reporting. Parents can pay their balance through both the Playground mobile app and the web with Stripe, Playground’s secure payment processor.

Support Resources for Families

Child care providers can also provide information and resources to support families in meeting their payment obligations. Here are some support resources to consider:

Government Assistance Programs

Inform families about government assistance programs that can help cover child care costs. These programs may include subsidies, vouchers, or tax credits that can alleviate financial burdens for families.

Non-Profit Organizations and Charities

Connect families with non-profit organizations and charities that offer financial assistance for child care expenses. These organizations may have specific eligibility criteria, but they can provide valuable support to families in need.

Community-Based Support Systems

Encourage families to seek support from community-based organizations or support groups. These networks can provide guidance, resources, and advice on managing child care payments effectively.

Best Practices for Child Care Providers

To minimize delinquent child care payments, providers should adopt best practices in their operations. Here are some best practices to consider:

Regular Financial Audits

Conduct regular financial audits to ensure accuracy and transparency in payment records. Audits can help identify any discrepancies or errors and allow providers to address them promptly.

Training Staff on Payment Processes

Ensure that administrative staff members are well-trained in payment processes and policies. This includes educating them on how to handle payment-related inquiries, assist families with payment options, and address any payment issues that may arise.

Maintaining Positive Relationships with Families

Building and maintaining positive relationships with families can help foster open communication and trust. Providers should strive to create a supportive and understanding environment where families feel comfortable discussing payment concerns or difficulties.

Conclusion

Addressing delinquent child care payments is crucial for both child care providers and families. By implementing proactive strategies, effective payment collection techniques, and utilizing technological solutions, providers can reduce delinquency rates and ensure the financial stability of their operations.

Leveraging software such as Playground can streamline your payment collection process and reduce delinquent payments, while even potentially boosting revenue with automated late fees.

Additionally, by providing support resources and adopting best practices, providers can help families navigate their payment obligations and maintain access to quality child care services.

Ultimately, you are a business and should be treated as one. Just as your families would not second-guess paying Amazon on time for their services, they should be respectful of your services and pay on time.

Be sure to have policies and procedures in place to clarify your payment collection process. Additionally, supporting families in meeting their payment obligations can alleviate financial stress and contribute to a positive and trusting relationship between providers and families.

Delinquent payments can have a significant impact on the way you manage childcare billing. As a childcare business, delinquent payments impact your cashflow and, in the most serious cases, may cause your business to close. For families, delinquent payments may lead to losing their spot in your child care program alongside potentially upsetting discussions.

In this article, we’ll explore what delinquent child care payments are, their consequences, and how to prevent delinquent payments.

What are Delinquent Child Care Payments?

Delinquent child care payments refer to payments that are overdue or unpaid by parents or guardians for child care services. This can be anything from tuition deposits, recurring tuition billing, or one-off fees (late fees, field trips, etc). As a child care business, your most frequent payment collection is tuition to cover the costs of providing care for children. Tuition is typically collected on a recurring basis (weekly, bi-weekly, or monthly).

How Does Delinquency Impact Providers and Families?

The effects of delinquent child care payments can be detrimental to providers who rely on these payments to cover their expenses, such as staff salaries, facility maintenance, and supplies.

When payments are not made on time or not at all, it can create financial strain and make it difficult for providers to continue offering quality care. You may lose staff members, be unable to pay rent, or unable to pay yourself - all of these can cause your business to close and will impact all of your families, not just the family that is overdue in their payments.

You should strive to have as few delinquent payments as possible.

For families, delinquent child care payments can resulting in suspension or termination of child care services, leaving parents or guardians in a difficult position to find alternative care.

Proactive Strategies to Prevent Delinquency

To reduce delinquent child care payments, you, as a child care provider, must implement proactive strategies.

Here are some effective strategies to consider:

Clear Communication of Payment Policies

You should clearly communicate your payment policies in your policy handbook. Make sure to share this with families when they join your program and have them sign off that they have read and agree to your policies.

Need help bulletproofing your policies? Check out our comprehensive guide to writing your child care policies.

For your policies, make sure you outline the following:

Tuition collection frequency

Accepted payment methods

Consequences for late or missed payments

By setting clear expectations, families are more likely to understand their obligations and make timely payments.

Flexible Payment Options

Offering flexible payment options can help families manage their child care expenses more effectively. This can include accepting different payment frequencies (weekly, bi-weekly, monthly), allowing payments to be made online or through mobile apps, or offering discounts for early or on-time payments. By accommodating different financial situations, you can increase the likelihood of receiving timely payments.

Playground makes it easy for child care providers to offer flexible payment options. Through the billing tool, administrators can create and edit payment plans, with options and customization of payment frequency.

Early Identification of Payment Issues

Providers should establish a system to identify potential payment issues early on. This can include regular monitoring of payment records, proactive communication with families who consistently make late payments, and offering assistance or resources to families facing financial difficulties.

By addressing payment issues promptly, providers can prevent them from escalating into consistent delinquency.

Playground automatically sorts which students have overdue balances in the “statements” section. This makes it easy for you to understand which families are late on payments and need to be contacted.

Effective Payment Collection Techniques

In addition to proactive strategies, you can employ effective payment collection techniques to reduce delinquency. Consider trying the following techniques:

Setting Up Automated Payment Systems

Implementing automated payment systems streamlines the payment process for families and reduces the likelihood of late or missed payments. Providers can set up recurring payments or send automated reminders to families, ensuring that payments are made on time.

Playground automatically sends upcoming payment deadline reminders to your families, taking another task off your list.

Implementing Late Fees and Incentives

By implementing late fees for overdue payments and incentives like discounts or credits for on-time payments, providers can encourage families to prioritize their payment obligations. Late fees can serve as a deterrent for delinquency, while incentives can reward families for their timely payments.

Set up automatic late fees within Playground and review them before either charging them to your family accounts or forgiving the fee. Check out this video for more information on how to add late fees on Playground.

Offering Payment Plans

For families facing financial difficulties, offering payment plans can provide them with a manageable way to fulfill their payment obligations. Providers can work with families to establish a payment schedule that fits their budget, ensuring that payments are made consistently.

Implementing these payment techniques is a breeze on Playground. From payment plans to late fees and incentives, Playground can help you avoid delinquent payments and manage billing all in one place with easy-to-use features like payment reminders to inform guardians about overdue payments.

Intervention Methods for Delinquent Accounts

Despite proactive strategies and effective payment collection techniques, some accounts may still become delinquent. In such cases, you can consider intervention methods to address delinquency.

Here are some steps you can take:

Mediation and Counseling Services

Providers can offer mediation or counseling services to families with delinquent accounts. This can help identify the underlying reasons for non-payment and explore potential solutions. Mediation can be a constructive way to resolve payment disputes and establish a repayment plan.

Working with Collection Agencies

In cases where other methods have been unsuccessful, providers may choose to work with collection agencies. These agencies specialize in recovering delinquent payments and can take legal action if necessary.

However, you need to ensure compliance with applicable laws and regulations when you engage with collection agencies.

Legal Actions and Court Procedures

As a last resort, you may need to pursue legal actions and court procedures to recover delinquent payments. This can involve filing a lawsuit against the non-paying party and seeking a judgment for the owed amount.

Legal actions should be taken following local laws and with the guidance of legal professionals. This is a bigger financial investment and takes considerable effort.

Federal Support

The federal government provides support and enforcement measures to address delinquent child care payments. This includes programs such as the Child Care and Development Fund (CCDF), which provides financial assistance to low-income families for child care services.

Additionally, federal agencies may enforce child support orders to ensure that parents fulfill their financial obligations.

Technological Solutions to Manage Payments

Technology can play a significant role in managing child care payments more efficiently. Here are some technological solutions to consider:

Utilizing Child Care Management Software

Child care management software can streamline payment processes by automating tasks such as invoicing, payment tracking, and reporting. These software solutions can help providers stay organized, reduce administrative burdens, and improve overall payment management.

Mobile Payment Apps and Platforms

Mobile payment apps such as Venmo or Zelle provide convenience for families to make payments on the go. Keep in mind that starting in 2024, you will need to submit a 1099-K form to the IRS to report revenue received from third-party payment networks like Venmo or CashApp.

Currently, third-party payers must issue a 1099-K if a taxpayer has over $20,000 in gross revenue or 200 transactions on the platform. By offering mobile payment options, providers can increase the accessibility and ease of making payments, reducing the likelihood of delinquency.

In Playground, you can easily track payments made in third-party payment networks, keeping your books organized and simplifying your taxes.

Online Payment Portals and Security

Implementing secure online payment portals can provide families with a safe and convenient way to make payments. These portals can offer encryption and other security measures to protect sensitive financial information. By ensuring the security of online payments, providers can build trust with families and encourage timely payments.

Playground’s billing tool offers features such as invoicing, payment tracking, and reporting. Parents can pay their balance through both the Playground mobile app and the web with Stripe, Playground’s secure payment processor.

Support Resources for Families

Child care providers can also provide information and resources to support families in meeting their payment obligations. Here are some support resources to consider:

Government Assistance Programs

Inform families about government assistance programs that can help cover child care costs. These programs may include subsidies, vouchers, or tax credits that can alleviate financial burdens for families.

Non-Profit Organizations and Charities

Connect families with non-profit organizations and charities that offer financial assistance for child care expenses. These organizations may have specific eligibility criteria, but they can provide valuable support to families in need.

Community-Based Support Systems

Encourage families to seek support from community-based organizations or support groups. These networks can provide guidance, resources, and advice on managing child care payments effectively.

Best Practices for Child Care Providers

To minimize delinquent child care payments, providers should adopt best practices in their operations. Here are some best practices to consider:

Regular Financial Audits

Conduct regular financial audits to ensure accuracy and transparency in payment records. Audits can help identify any discrepancies or errors and allow providers to address them promptly.

Training Staff on Payment Processes

Ensure that administrative staff members are well-trained in payment processes and policies. This includes educating them on how to handle payment-related inquiries, assist families with payment options, and address any payment issues that may arise.

Maintaining Positive Relationships with Families

Building and maintaining positive relationships with families can help foster open communication and trust. Providers should strive to create a supportive and understanding environment where families feel comfortable discussing payment concerns or difficulties.

Conclusion

Addressing delinquent child care payments is crucial for both child care providers and families. By implementing proactive strategies, effective payment collection techniques, and utilizing technological solutions, providers can reduce delinquency rates and ensure the financial stability of their operations.

Leveraging software such as Playground can streamline your payment collection process and reduce delinquent payments, while even potentially boosting revenue with automated late fees.

Additionally, by providing support resources and adopting best practices, providers can help families navigate their payment obligations and maintain access to quality child care services.

Ultimately, you are a business and should be treated as one. Just as your families would not second-guess paying Amazon on time for their services, they should be respectful of your services and pay on time.

Be sure to have policies and procedures in place to clarify your payment collection process. Additionally, supporting families in meeting their payment obligations can alleviate financial stress and contribute to a positive and trusting relationship between providers and families.

Playground is the only app directors need to run their early child care center. Playground manages marketing, registration, billing, attendance, communication, paperwork, payroll, and more for child care programs. 300,000+ directors, teachers, and families trust Playground to simplify their lives.

Learn more by scheduling a free personalized demo.

See what Playground can do for you

Learn how our top-rated child care management platform can make your families & teachers happier while lowering your costs

Related articles

Stay in the loop.

Sign up for Playground updates.

Stay in the loop.

Sign up for Playground updates.

Stay in the loop.

Sign up for the updates.

© 2025 Carline Inc. All rights reserved.

© 2025 Carline Inc. All rights reserved.

© 2025 Carline Inc. All rights reserved.

How to Reduce Delinquent Payments in Child Care Businesses

Published Jan 10, 2024

|